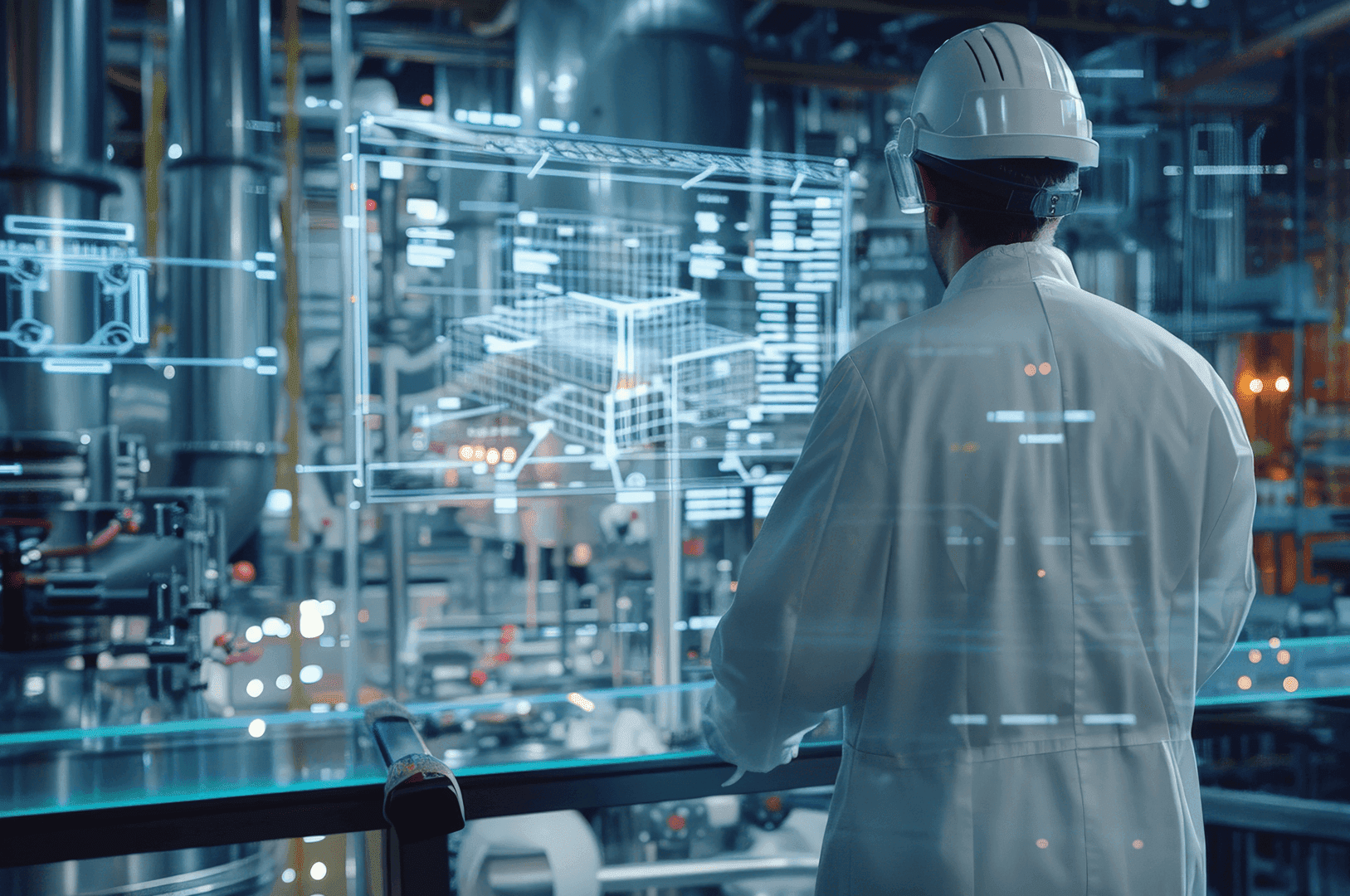

We engage directly with Chief Procurement Officers, Plant Heads, and Logistics Leaders to deliver intelligence on sourcing risks, cost benchmarks, plant-level inefficiencies, vendor selection, and procurement behavior-supporting strategic decisions across procurement, operations, and logistics.

Insight-to-Action Story

For an industrial equipment client, our decision-maker persona research revealed friction in procurement workflows. Insights from CPOs and plant managers led to a 22% improvement in procurement turnaround time and reshaped their CAPEX/OPEX messaging strategy.