Construction

Why Construction Projects Miss Their Start Dates?

A leading manufacturer of premium windows and doors sought to understand how dealers make brand decisions, what drives brand loyalty, and how product attributes, service experience, and marketing efforts impact their position in a competitive landscape. The goal was to refine channel strategy, positioning, and value communication with dealer partners across North America.

Multi-Method Research

Vertically Integrated Execution

We managed the full research lifecycle:

Survey Methodology

Executive Profiling & Segmentation

1. Strategic Decision Criteria

MaxDiff Allocation - Brand Selection Drivers:

Dealers allocated 100 points across key purchase drivers:

Top 3 Purchase Criteria | Avg. Weight |

|---|---|

| Product Quality | 22 pts |

| Profitability/Margin | 18 pts |

| Ease of Doing Business | 16 pts |

These three pillars outweighed marketing, aesthetics, and architect demand - signaling a strong operational lens in dealer evaluations.

Quality Perception Model:

Dealers define quality through:

Brand alone contributed just 12% of the perceived quality score - highlighting an opportunity for lesser-known brands to compete through technical proof points.

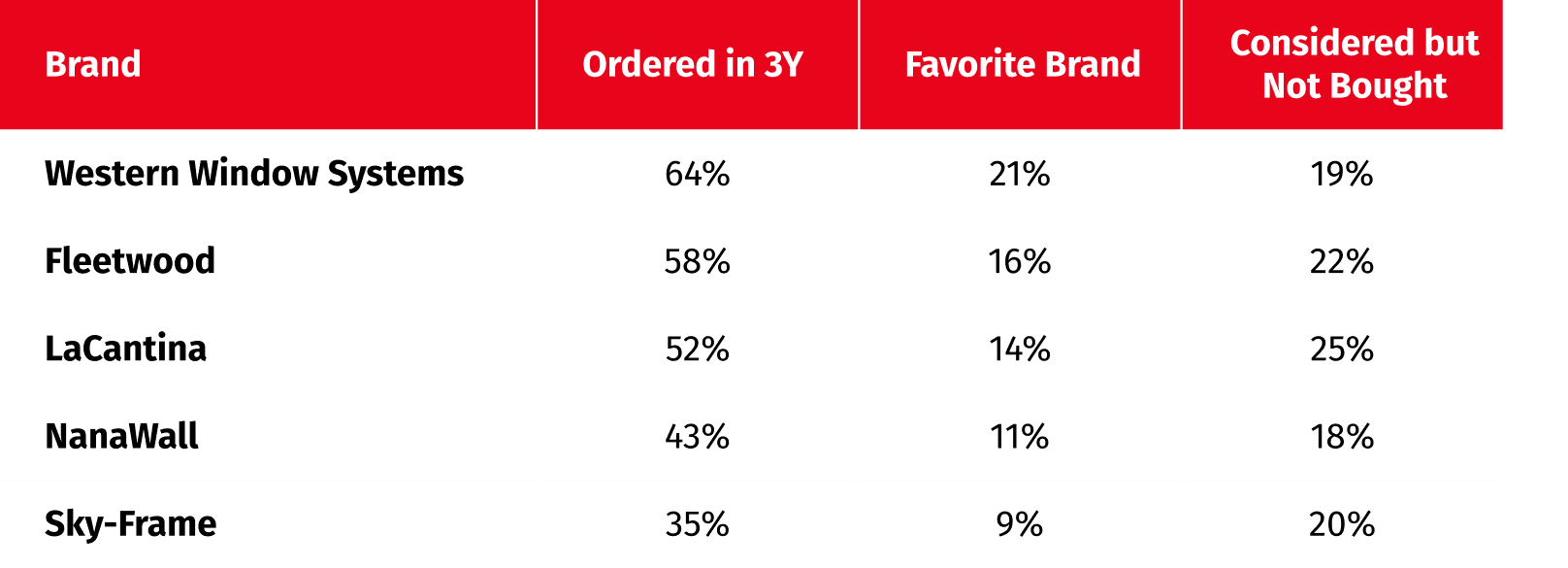

2. Brand Funnel & Competitive Positioning

Survey measured 5 levels of brand familiarity and engagement (from unaware → favorite brand). Key brand insights:

Insight: Brands like NanaWall and Sky-Frame had high consideration-to-purchase drop-off, indicating potential friction in pricing, delivery, or service experience.

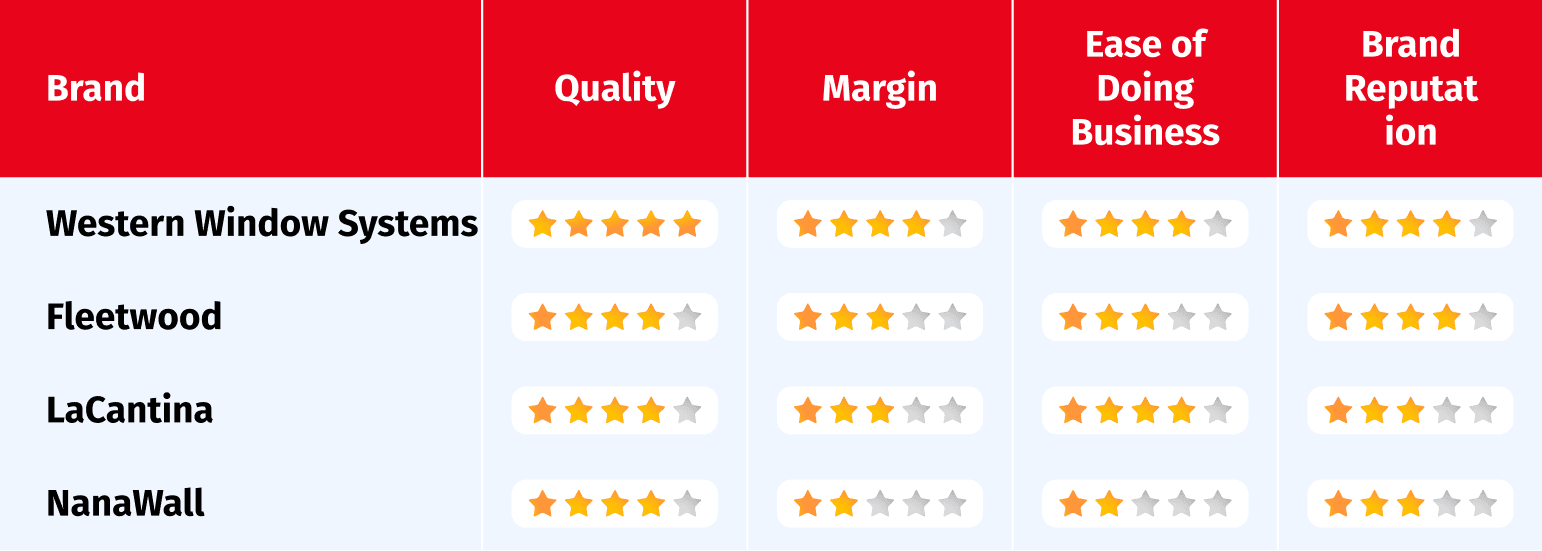

3. Brand Performance Mapping

Respondents evaluated selected brands on 11 purchase drivers. Results were normalized into a performance matrix.

Western led in delivery, margin, and reputation, confirming its position as a preferred, full-service partner. Fleetwood excelled in brand recognition but lagged in dealer service.

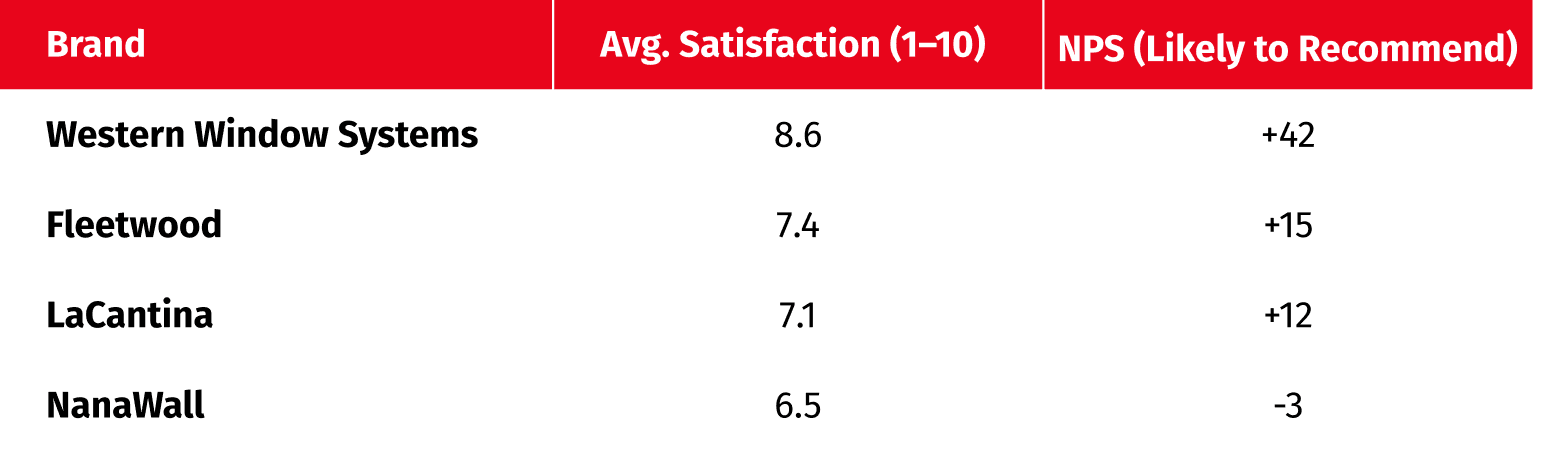

4. Net Promoter Score (NPS)

Dealers rated their satisfaction and likelihood to recommend each brand.

Insight: Western’s combination of high satisfaction and strong recommendation likelihood underscores its loyal dealer base. NanaWall’s drop-off highlights a perception gap between product quality and broader dealer experience.

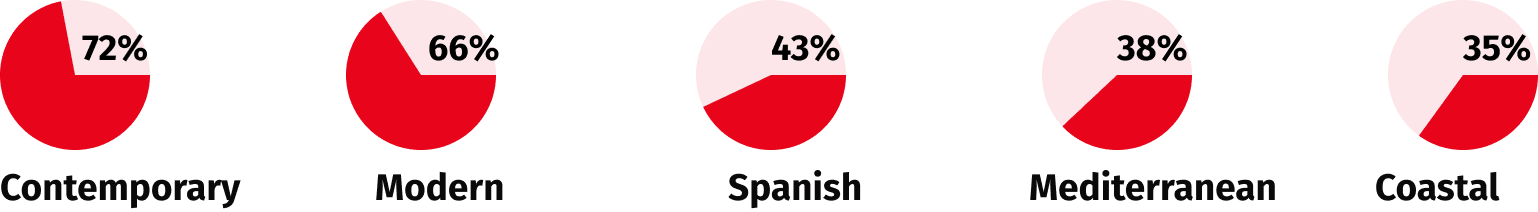

5. Emerging Style Trends

Dealers were asked how architectural styles are trending in their markets.

Strategic Opportunity:

Modern and contemporary homes are driving demand — brands with sleek profiles, large glass panels, and minimalist hardware are best positioned to grow.

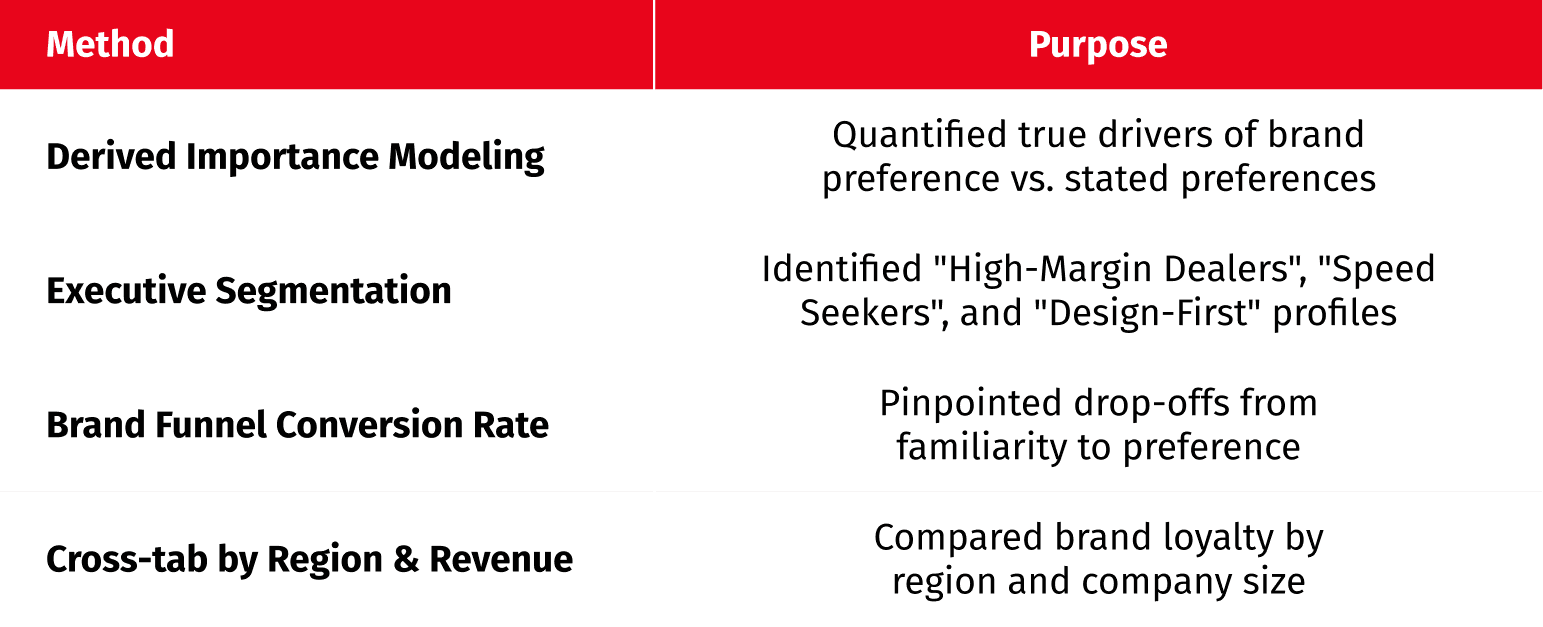

Advanced Analytics Toolkit

1. Double Down on Dealer Experience

2. Win at the Point of Design

3. Segmented Outreach Strategy

The client applied this insight to: