Technology

Unlocking the Enterprise Buyer

As the digital asset management landscape becomes increasingly competitive, institutional players are racing to adopt robust, secure, and scalable solutions. Fireblocks, a leading blockchain infrastructure provider, recognized the need to benchmark its performance in a rapidly expanding ecosystem where enterprise blockchain adoption, crypto custody solutions, and institutional crypto infrastructure platforms are evolving daily.

With more institutions exploring digital asset integration with enterprise IT infrastructure, it became essential for Fireblocks to assess its position against peers like BitGo, Copper, Coinbase Custody, and Metaco, and understand the real drivers of institutional crypto adoption.

The research was designed to uncover deep insights into:

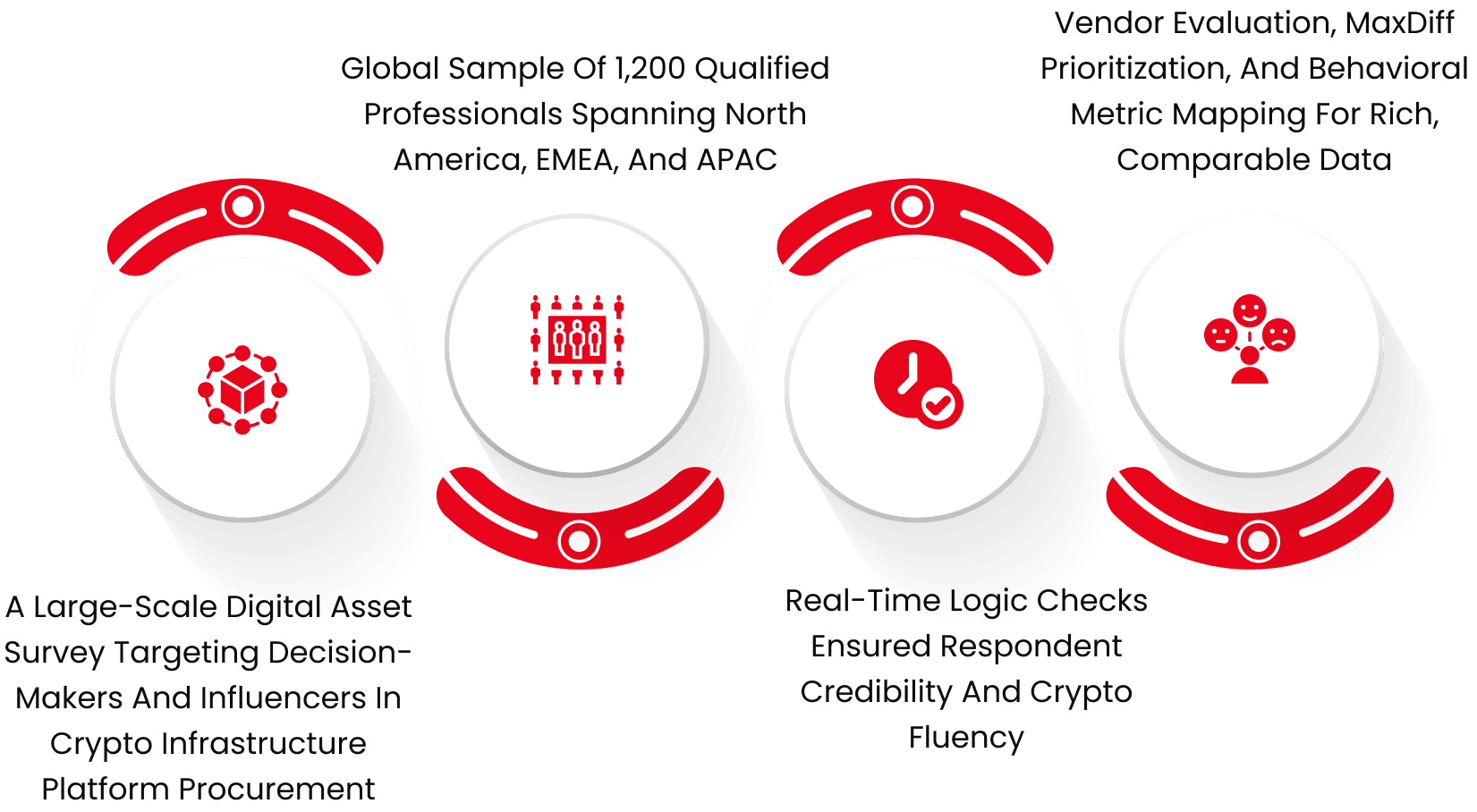

Through our Executive Decision Insights framework, we deployed a multi-method market positioning research strategy that combined robust quantitative analysis with strategic consultation.

Key Highlights:

Immersion & Kickoff

The engagement began with a deep-dive session with Fireblocks’ leadership, aligning on business goals and framing hypotheses around brand awareness, perceived value, and product gaps in the institutional crypto custody ecosystem.

Survey Design

The questionnaire was designed to capture insights into:

Measurement Tools

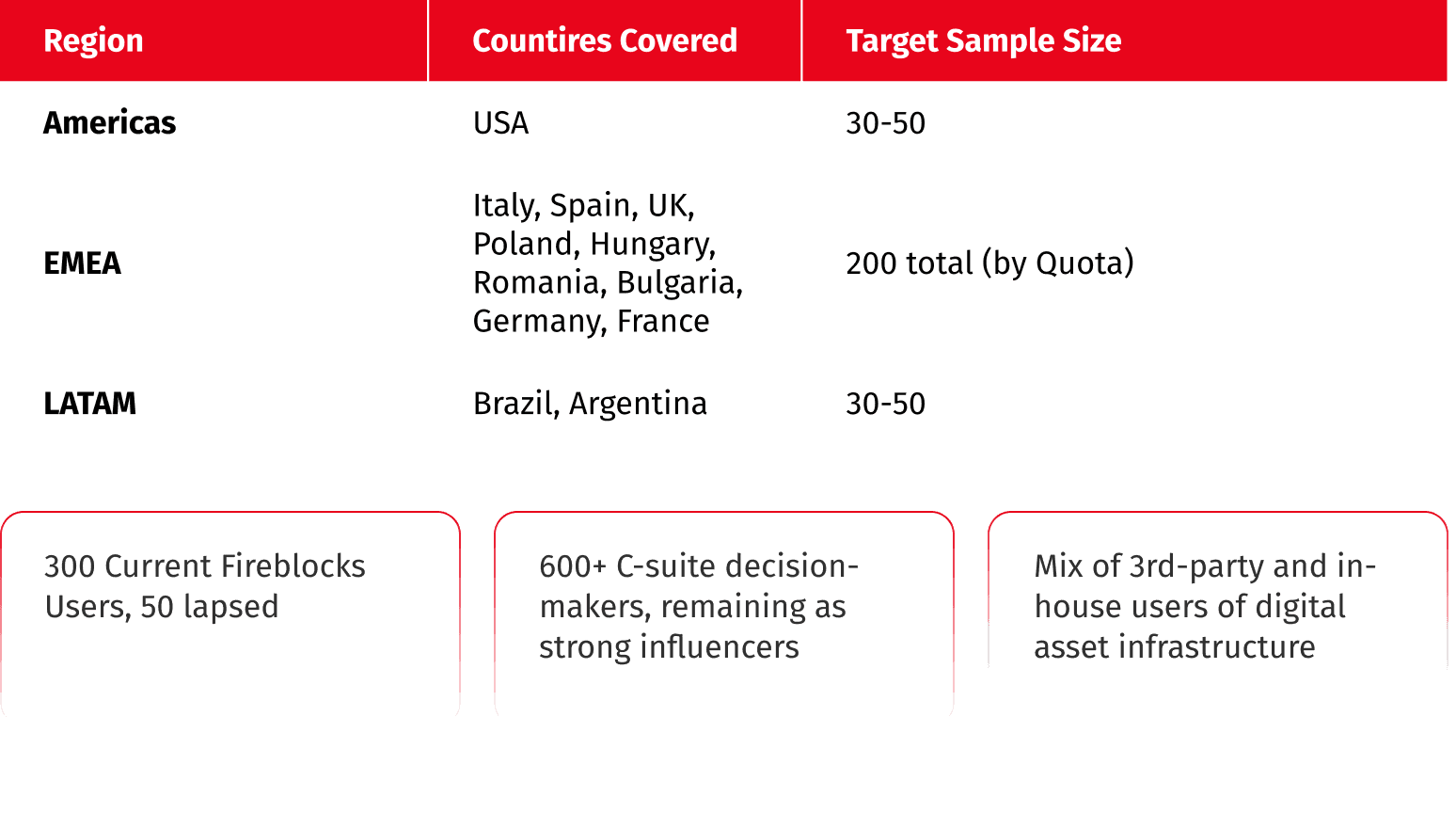

Sample Coverage: Global Reach, Local Depth

A total of 1,200 enterprise respondents participated, reflecting a mix of current Fireblocks users, lapsed users, and those aware but not using the platform.

The Fireblocks Brand Study offered real-time, strategic visibility into how global institutions view the brand versus key Fireblocks alternatives.

Armed with these digital asset survey insights, Fireblocks was able to:

This study positioned Fireblocks at the center of evolving digital asset technology trends, confirming its role as a premier crypto asset security platform for enterprises. It delivered not just data-but direction-enabling Fireblocks to stay ahead in the rapidly changing enterprise blockchain solutions space.

For any organization looking to understand the enterprise preferences in blockchain solution providers, this is the gold standard in digital asset vendor comparison.

Explore how we help blockchain leaders like Fireblocks decode the future of crypto technology.

Contact us to design your next global B2B research initiative in the digital asset space.