Retail

Uncovering the procurement practices, pain points, and unmet needs of SMEs

As a global leader in protein production and food innovation, Tyson Foods sought to understand how its corporate reputation, brand image, and ESG-related efforts are perceived across critical markets and influential stakeholders.

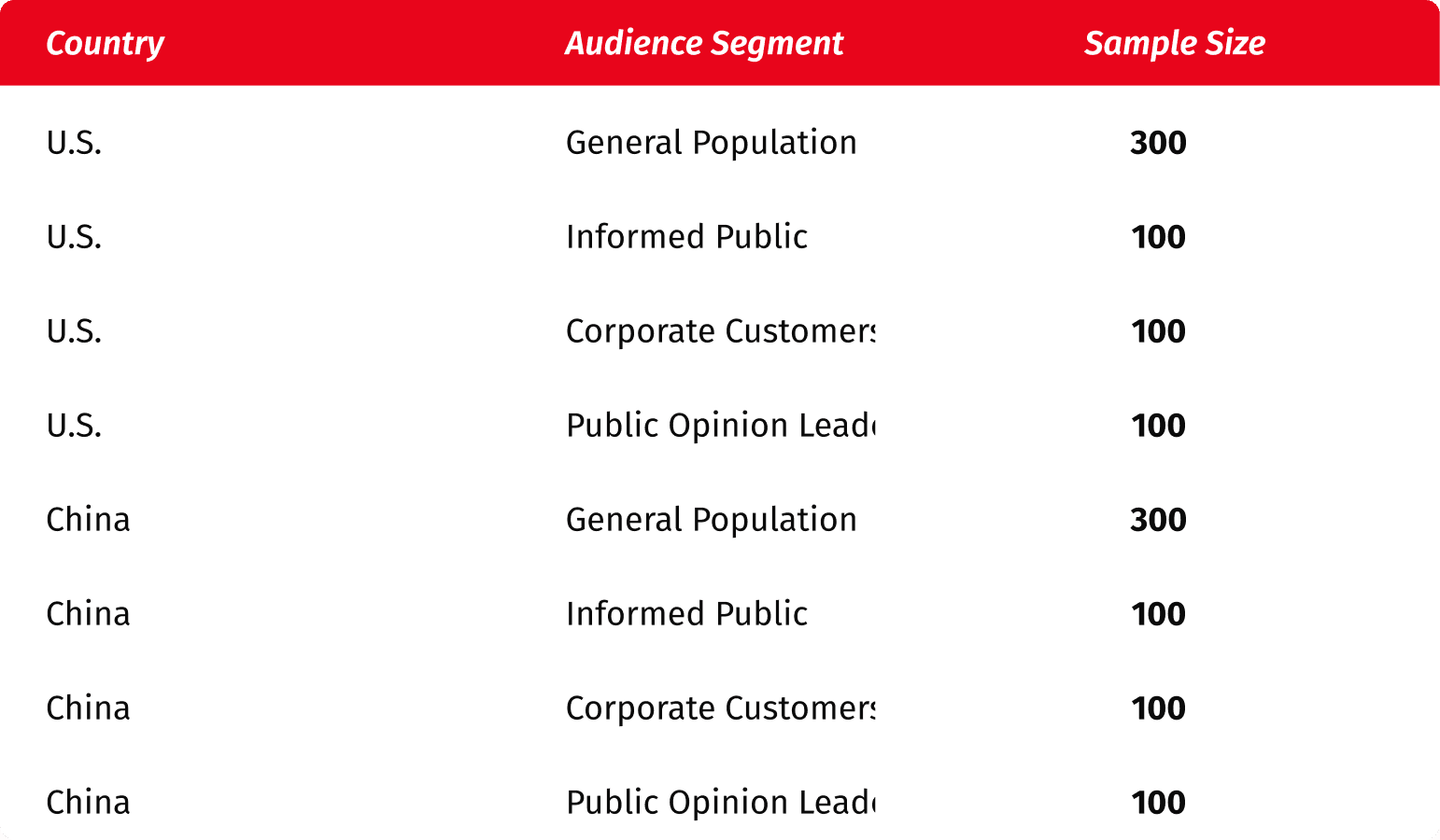

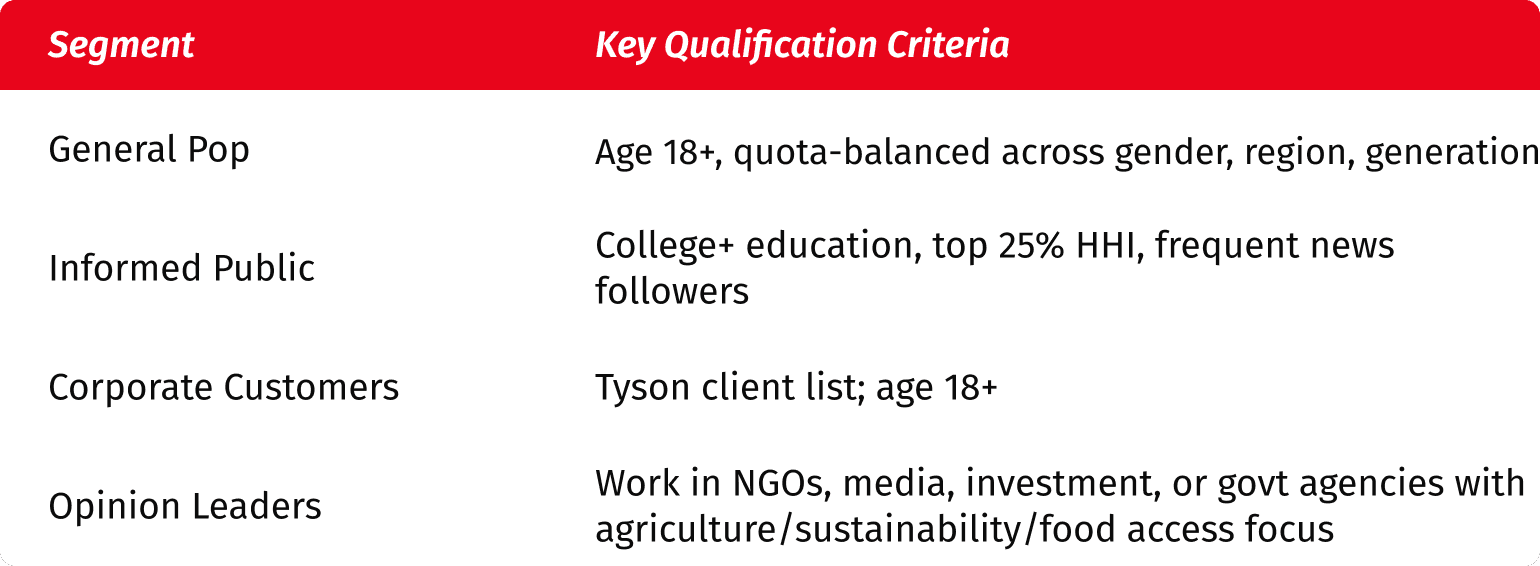

a. Multi-Audience Survey Framework

The survey targeted a diverse and segmented audience to generate 360° insights:

b. Vertically Integrated Methodology

c. Module Overview

Geo Quotas Applied: U.S. regional split (Northeast, Midwest, South, West); China region stratification across 30+ provinces

a. Brand Funnel Metrics – Tyson Foods

b. Trust & Values (ETM)

c. Brand Attribution Strengths

Tyson was associated with:

…but showed weaker perceptions around:

d. Protein & Food Ethics

e. Public Perceptions of Food Companies

f. Message Resonance

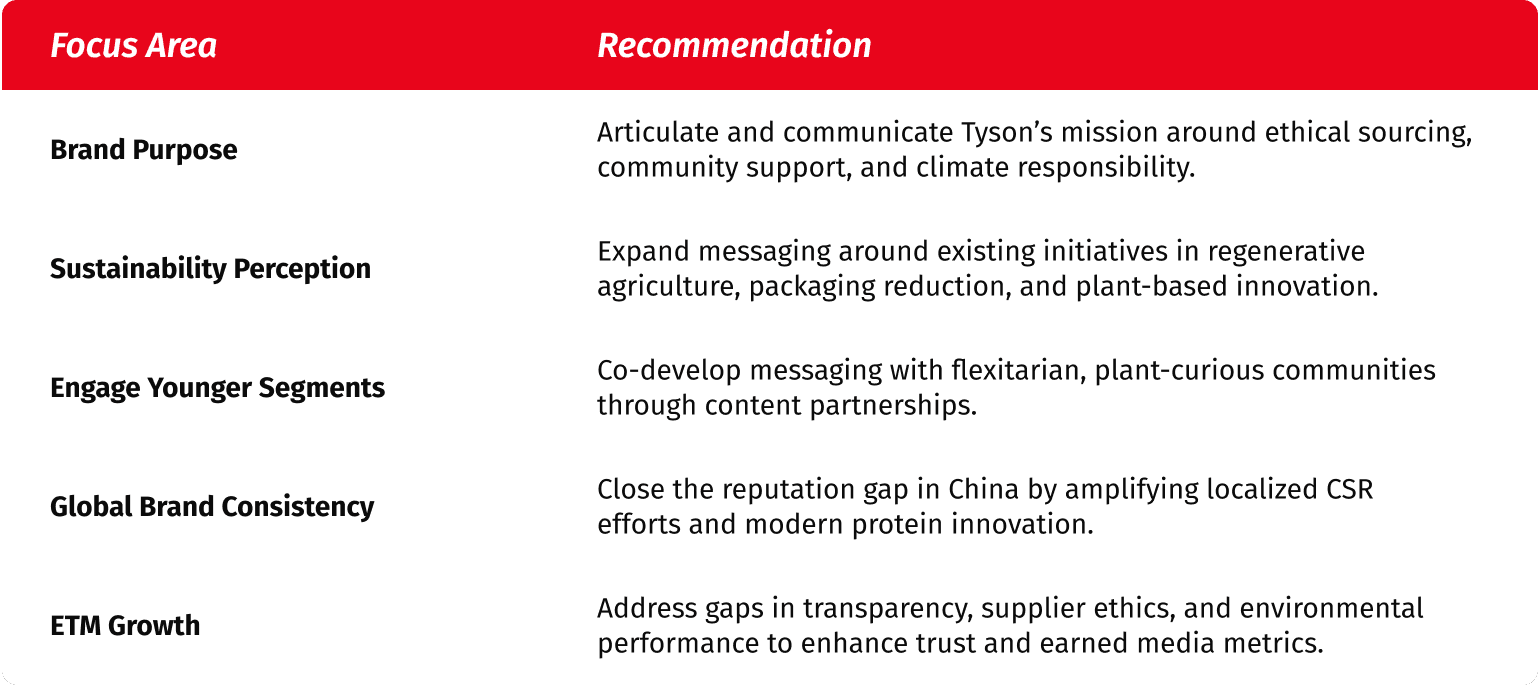

This study enabled Tyson Foods to:

Outcome: Data used to develop a reputation dashboard for quarterly tracking, with direct linkage to media planning and ESG communication strategies.