Construction

Why Construction Projects Miss Their Start Dates?

In the competitive world of test and measurement software, one leading enterprise software provider faced a critical challenge: their customer segmentation strategy was falling short. Over-reliant on firmographics and lacking behavioral depth, their existing model couldn’t keep up with the evolving demands of industries like Aerospace & Defense, Semiconductors, and Automotive.

With rising pressure from open-source alternatives, niche SaaS players, and shifting buyer expectations, the provider recognized a need for deeper B2B customer segmentation. What they needed was clear: a behavior-based customer segmentation framework that combined psychographics, usage patterns, and value drivers.

To create a robust, scalable, and insight-rich segmentation that captured:

This would inform their go-to-market (GTM) efforts, product strategy, and enterprise software CRM segmentation models.

1. Immersion & Hypothesis Framing

The project began with an audit of internal CRM data, software usage analytics, and past market segmentation strategy. Working closely with client teams, we aligned on three core goals:

2. Qualitative Deep Dives

We conducted 15 in-depth interviews with stakeholders from OEMs, component manufacturers, and systems integrators. These discussions unearthed insights into:

3. Segmentation Survey Design & Execution

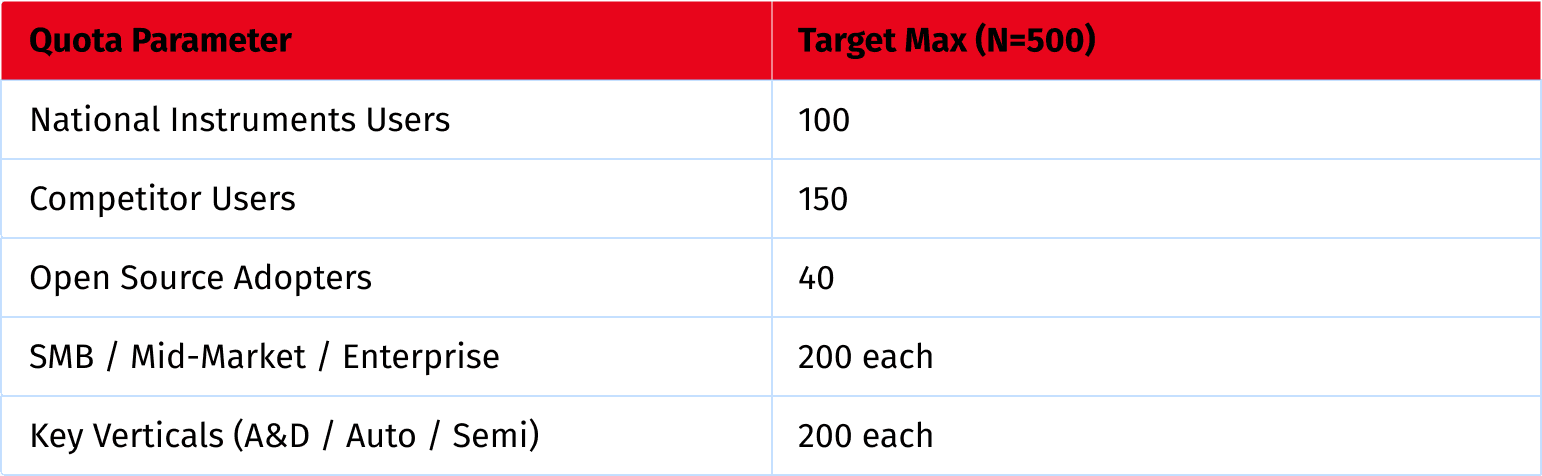

A robust segmentation survey for tech companies was deployed to 500 qualified respondents across the U.S. and Canada. Using stringent screening, we ensured representation across:

The 15-minute survey explored SaaS buyer behavior analysis, feature preferences, and license inclinations.

4. CRM & Behavioral Data Fusion

Survey responses were mapped to CRM fields such as:

This integration formed the foundation of our CRM tagging strategy and churn prediction modeling.

5. Advanced Segmentation Analytics

We applied PCA (Principal Component Analysis) to reduce dimensions and uncover behavioral constructs such as:

These constructs informed clustering models based on feature prioritization (MaxDiff), license models, and switching friction. This software segmentation analysis ensured practical, predictive, and commercially relevant clusters.

6. Segment Typology & Workshop

Two final models were introduced:

In collaboration with client GTM teams, we refined and validated four distinct T&M software buyer personas:

7. Activation & Enablement

We built a lead typing tool to classify buyers during onboarding and inbound journeys. Simultaneously, a Salesforce-integrated CRM segmentation logic was implemented to ensure:

Through this deep-dive into enterprise SaaS segmentation, our client evolved from a generic, firmographic GTM model to a behaviorally intelligent one-fusing what buyers say, what they do, and how they engage. With clear T&M software buyer profiling, smarter B2B pricing strategies, and embedded CRM logic, the company is now equipped to grow with precision, reduce churn, and truly understand the software adoption research behind their most valuable customers.

This is more than segmentation.

It’s customer empathy, powered by data.