Multiple

Global ESG Ratings Research - Understanding How Enterprises Evaluate Sustainability Standards

In a competitive and fragmented global aftermarket for automotive powertrain components, a leading global manufacturer aimed to understand distributor and retailer perceptions of leading powertrain suppliers across key regions- North America, EMEA, and LATAM. The study was designed to measure brand awareness, supplier performance, purchasing decision dynamics, and Dayco’s relative positioning.

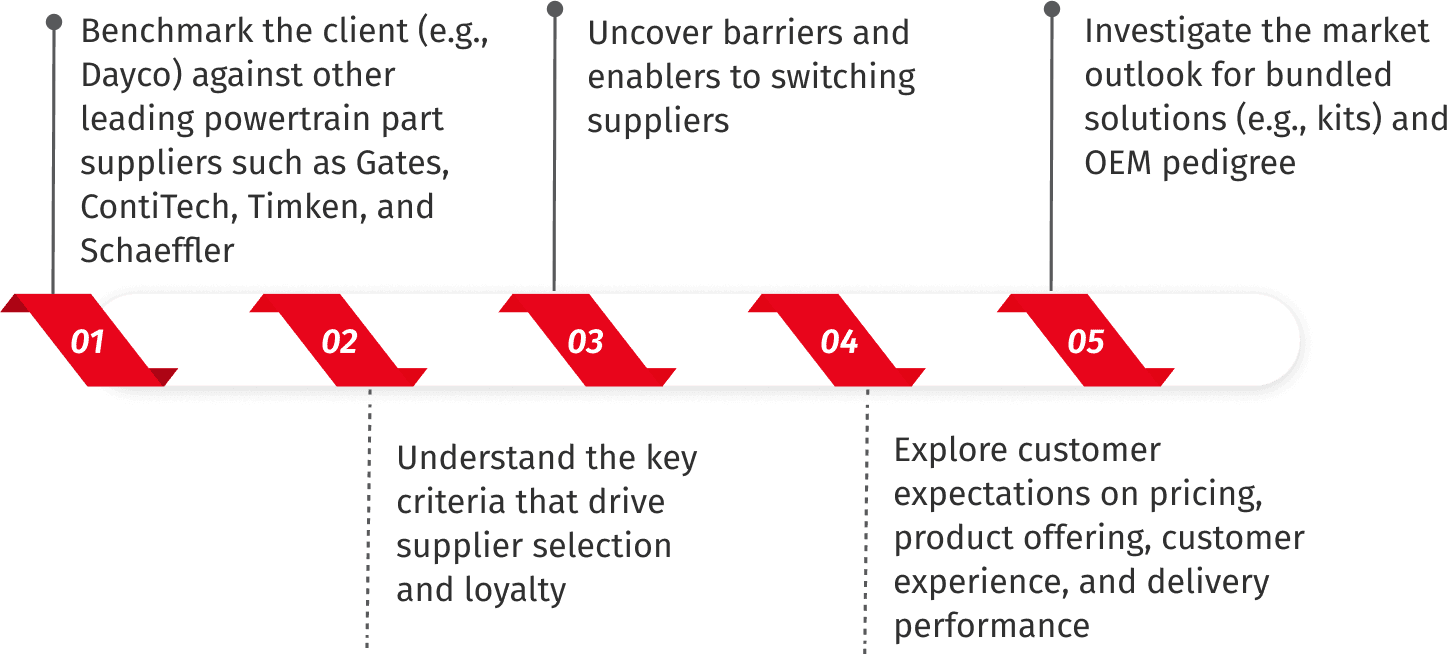

The study sought to:

A B2B phone-based interview study was conducted using a standardized 30-question script across three regions. This method allowed for deeper contextual feedback, high-quality data capture, and real-time clarification of complex responses.

Survey Design:

Target Respondent Profile:

Sampling Framework

1. EMEA Quotas by Country:

2. Balance Quotas:

1. Supplier Brand Awareness:

2. Customer Needs & Purchasing Criteria:

3. Supplier Share of Wallet & Loyalty:

4. Customer Experience & Performance Scoring:

5. Channel Preferences & Brand Strategy:

6. Market Outlook:

The study provided:

The insights enabled the client to: