Multiple

Global ESG Ratings Research - Understanding How Enterprises Evaluate Sustainability Standards

A few years ago, GLP-1 medications like Ozempic, Zepbound, and Saxenda, were largely medical treatments discussed in clinics and endocrinology journals.

Today, they show up in places many would never have anticipated: in grocery baskets, on beverage aisles, in fashion stock rooms, and in strategic planning decks for global brands.

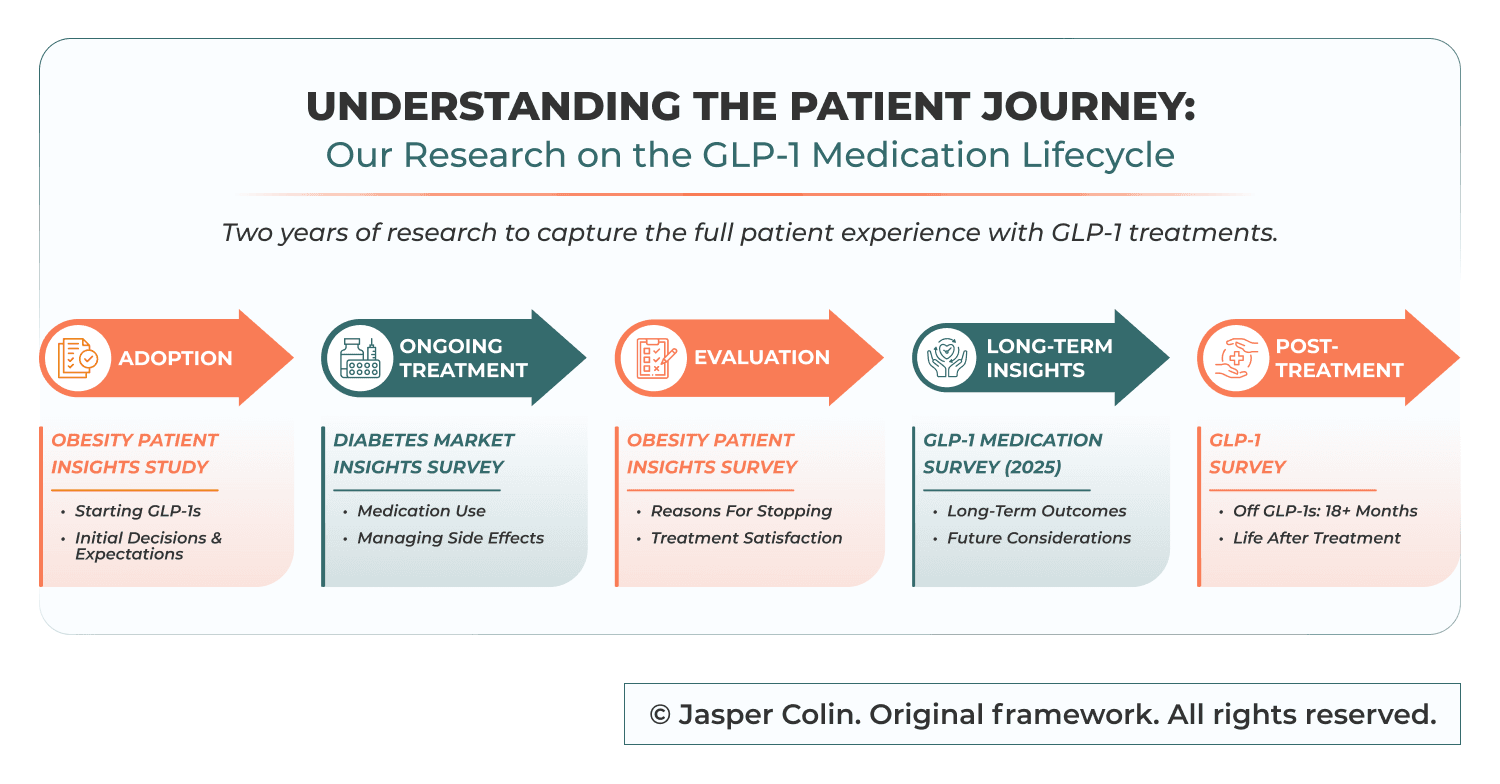

This isn’t trend hype. This is behavior change, and Jasper Colin’s research over the past two years has been tracking it closely. Our studies went on to capture patient experiences in five different phases:

This research lens matters because GLP-1 disruption is not linear. Consumers do not behave the same way at month 2 versus month 18.

And for brands, those behavioral shifts determine whether categories decline, transform, or explode.

For decades, obesity rates in the U.S. remained stubbornly high, hovering near 40%. But recent surveys suggest early signs that obesity rates may be flattening or even slightly declining, an inflection point after decades of steady growth.

This shift is closely tied to rapid GLP-1 adoption, with surveys suggesting that roughly 1 in 8 U.S. adults have tried a GLP-1 drug.

Meanwhile, the commercial scale is undeniable. Novo Nordisk reported $31.1 billion in revenue in 2024 from Ozempic, and Rybelsus, up from $11.9 billion in 2022. These three drugs accounted for roughly 70% of Novo Nordisk’s total revenue.

But the bigger disruption is not the revenue. It is the behavioral redesign of the American consumer. Cravings are changing. Portions are changing. Habits are changing. Identity is changing. And when that happens, industries don’t just get disrupted-they get rewritten.

Jasper Colin’s research doesn’t treat GLP-1 as a drug trend. It treats it as a consumer segmentation revolution.

Because GLP-1 users are not one group. They split into distinct segments:

Each segment has different spending behavior, brand loyalty, and lifestyle priorities.

This is exactly where Jasper Colin’s expertise becomes critical: connecting human behavior insights to category-level market impact. Below is how Jasper Colin’s GLP-1 research journey helps decode the ripple effects across major industries.

In consumer interviews and longitudinal behavior studies, a consistent pattern emerges: GLP-1 users don’t just eat less, they shop differently.

A typical grocery cart begins to lose what it once relied on-impulse snacks, sugary treats, late-night indulgence items, and high-calorie convenience foods. Instead, purchases shift toward what many users describe as “food that feels worth it”: lean proteins, fresh produce, nutrient-dense meals, and functional foods that deliver value per bite.

For FMCG brands, this shift creates a new reality: consumption is becoming less volume-driven and more utility-driven. Categories that grew through frequent snacking occasions may see softening demand, while categories built around satiety, protein, and functional health may see sustained expansion.

This is precisely where Jasper Colin’s work across consumer journey mapping, segmentation, and category demand forecasting becomes critical. Over the past two years, ongoing interviews with diabetes patients and GLP-1 users have helped uncover how “health behavior” is no longer an abstract mindset, it is actively reshaping what households buy, how often they replenish, and which brands survive the trade-down vs trade-up battle.

And for FMCG companies, the next phase is not just identifying demand loss, it’s identifying the replacement logic: what replaces snacking, what replaces emotional eating, and what new consumption rituals emerge. That shift can’t be measured through single-quarter sales snapshots. It requires longitudinal tracking, basket-level analysis, and behavioral segmentation models that capture habit rewiring in real time.

In many cases, the earliest warning sign isn’t declining sales. It’s declining purchase frequency among historically high-value consumer segments.

Few industries expected GLP-1 drugs to influence alcohol consumption, but evidence is steadily building.

Many users report reduced desire for alcohol, and emerging scientific research suggests GLP-1 medications may impact reward pathways in the brain. That makes alcohol less appealing not only physically, but psychologically. The result is subtle but significant: fewer heavy-drinking occasions, lower indulgent consumption, and a growing openness to non-alcoholic alternatives.

For beverage brands, this shift could create a split market. Alcohol may not disappear, but it may become increasingly “occasion-based” rather than habitual, while non-alcoholic beverages, functional hydration drinks, and low-calorie wellness beverages gain traction as default choices.

This evolution aligns with Jasper Colin’s work in authority research, consumption occasion mapping, and behavioral segmentation, where the deeper goal is to understand what people are replacing alcohol with not just whether they’re drinking less. The question is no longer “Is alcohol declining?” It is “What is becoming the new social default?”

Brands now need to understand the emerging “social consumer persona”: one that values clarity, control, and health, while still wanting ritual and community. Jasper Colin’s contribution here extends beyond GLP-1 research, it includes identifying lifestyle-driven consumption triggers, testing emerging beverage concepts, and modeling how wellness-led consumers reshape category growth.

Because the next beverage war won’t be beer vs whiskey. It will be alcohol vs wellness.

Restaurants thrive on predictable consumer patterns: cravings, portion upsells, bundled meals, and impulse ordering. GLP-1 usage challenges that system directly.

Consumers on GLP-1s consistently report reduced interest in fried or heavy meals, smaller portions feeling sufficient, less spontaneous dining, reduced dessert purchases, and fewer add-on items.

But this doesn’t mean restaurants are doomed. It means the economic model may evolve. Rather than ordering more, consumers may trade up, fewer meals out, but higher expectations when they do. Protein-forward menu options, smaller portion pricing, and “clean comfort food” may become stronger levers than large-value meals.

This is where Jasper Colin’s ability to run menu concept testing, pricing and positioning research, and customer journey mapping becomes essential. Historically, QSR brands have been built on frequency and volume. The GLP-1 era forces them to understand a different metric: intentional consumption.

Through structured research frameworks such as conjoint-based menu optimization and behavioral segmentation, Jasper Colin helps restaurant brands understand whether consumers are reducing visits permanently or simply shifting occasions. The brands that win will be those that identify which consumption moments remain resilient, and how menus can be engineered to fit smaller appetites without shrinking profitability.

Because if this wave lasts, it won’t just change menus. It will change unit economics.

One of the clearest business impacts of GLP-1 adoption is showing up in fashion and apparel.

As more consumers lose weight, demand begins to shift toward smaller sizes. That may sound like a simple sizing adjustment, but retail inventory is a forecasting machine built on historical distribution curves-and those curves are now becoming unreliable.

Analysts have warned that billions in apparel inventory could become misaligned as demand patterns for L, XL, and XXL decline while smaller sizes rise. In some forecasts, as much as $5 billion in U.S. apparel stock could be at risk if retailers do not adjust size allocation models quickly enough.

This matters because apparel supply chains cannot pivot overnight. Manufacturers produce months in advance. Retailers allocate shelf space and warehouse capacity based on expected size mix. Which means the true risk isn’t consumer weight loss-it’s inventory inertia.

But the disruption doesn’t stop at retail shelves. A quieter secondary shift is emerging in the resale economy. As consumers rapidly transition through sizes, wardrobes are being replaced faster than usual, driving more clothing into secondhand platforms, trade-in programs, and peer-to-peer resale marketplaces. In many cases, GLP-1 users are not discarding clothing, they are monetizing it, swapping it, or recycling it into the resale ecosystem.

That creates an unusual dynamic: while traditional retailers face deadstock risk in larger sizes, resale platforms may see a surge of high-quality inventory in L/XL/XXL categories, along with rising demand for smaller sizes. In other words, GLP-1 adoption may not just shift what gets bought but also accelerate how quickly apparel cycles through the market.

This is exactly where Jasper Colin’s strength in demand modeling, segmentation, and opportunity mapping becomes highly actionable. As body size distributions evolve, retailers will need to rewrite the logic behind how they forecast size curves, store-level allocation, replenishment rules, and markdown planning. Resale players, meanwhile, will need to understand how this trend reshapes supply inflow, pricing elasticity, and category demand over time.

In practical terms, research is shifting too. Retailers and platforms are investing more heavily in wardrobe transition studies, demand modeling, and consumer panel tracking to understand how quickly shoppers “move downsizes,” how long they stay in a new size, and whether weight-loss driven apparel purchasing stabilizes or remains a recurring cycle.

And beyond Ozempic specifically, Jasper Colin’s work here supports a broader shift already underway: consumers demanding more adaptive sizing, more flexible wardrobe solutions, and more personalization in fit and product selection. In the coming years, the winners may not just stock the right sizes, they may build the smartest sizing intelligence engines across both retail and resale.

Rapid weight loss often comes with aesthetic side effects: skin elasticity shifts, facial volume loss, and body contouring concerns. Popular culture coined this as “Ozempic face,” but beyond the headline is a real consumer behavior pattern.

A growing segment of GLP-1 users is seeking aesthetic solutions not for glamour, but for transition support. They want to look like themselves again, just in a different body. That is pushing demand toward fillers and collagen stimulators, skin tightening procedures, body contouring, and medical-grade skincare.

For beauty brands and clinics, this creates an unusual opportunity: a consumer segment driven by transformation anxiety, not aspiration.

Jasper Colin’s contribution in this space is rooted in consumer perception research, brand positioning, and patient experience journey mapping. Beauty and aesthetics are a category shaped by trust, self-image, and subtle emotional triggers. The challenge is not identifying demand, it is understanding what language consumers respond to, what outcomes they expect, and what makes them hesitate.

Many beauty companies are now running perception research, pre/post weight-loss experience mapping, and treatment journey studies to identify how this segment chooses brands and what messaging reduces hesitation.

Because the future beauty consumer may not be buying “anti-aging.” They may be buying “post-change confidence.”

One of the most under-discussed consequences of GLP-1 weight loss is lean mass loss.

Clinical evidence suggests that a meaningful portion of weight lost through GLP-1 treatment can come from lean mass, especially if the consumer is not maintaining protein intake and resistance training. In some studies, lean mass loss represents as much as 25-40% of total weight lost.

This is not purely cosmetic. Lean mass is tied to metabolic health, long-term strength, mobility, and sustained weight maintenance.

And it is already shaping fitness behavior. Gym programs that once leaned heavily on cardio and calorie burn are pivoting toward resistance training packages, strength coaching, protein-first nutrition guidance, and body composition tracking.

This shift is forcing fitness brands to evolve their consumer promise. The “summer body” narrative is being replaced by a new priority: preserving muscle while losing fat.

Here, Jasper Colin’s research contribution spans beyond GLP-1 adoption into the larger health economy: behavioral segmentation of fitness consumers, program concept testing, and retention journey analysis. The key challenge gyms face isn’t attracting GLP-1 users, it’s keeping them engaged once the initial weight loss motivation plateaus.

Fitness providers increasingly rely on program concept testing, membership journey analysis, and behavioral retention research to determine what GLP-1 users actually stick to, because this consumer segment is often highly motivated early, but vulnerable to fatigue and inconsistency over time.

When consumers eat less overall, each bite becomes more valuable. That changes the economics of nutrition.

GLP-1 users often report increased interest in protein shakes, electrolytes, multivitamins, collagen supplements, and digestive health products. This is less about fitness culture and more about necessity. Reduced appetite makes it harder to meet nutritional targets through traditional eating patterns.

Functional nutrition brands are increasingly running usage and attitude studies, claims testing, and product format research to identify which delivery formats work best for appetite-suppressed consumers because the future of nutrition may depend not on flavor alone, but on convenience, digestibility, and perceived efficacy.

This is a space where Jasper Colin’s strength in product optimization research, pricing and positioning studies, and segmentation-led innovation becomes especially valuable. As functional nutrition becomes more mainstream, brands will need to identify which consumers are buying for performance, which are buying for medical wellness, and which are buying for “preventive lifestyle”, because each group responds to different claims and price thresholds.

The new consumer doesn’t want chips. They want 30 grams of protein in the smallest possible serving.

Even as GLP-1s transform consumer behavior, a major question remains unresolved: affordability.

Depending on insurance coverage, these medications can cost hundreds to over a thousand dollars per month in the U.S. That creates an adoption ceiling unless employers, insurers, and policymakers expand coverage. But the debate is not simple. The argument for broader access is built on long-term healthcare savings: reduced diabetes complications, fewer cardiovascular events, and lower obesity-related medical costs.

This is why insurers and employers are investing heavily in persistence studies, discontinuation drivers research, and real-world outcomes tracking. The goal is not just to know whether GLP-1s work but whether consumers stay on them long enough for the system to see measurable returns.

This aligns directly with Jasper Colin’s longitudinal research approach across the GLP-1 medication lifecycle, spanning adoption, ongoing treatment experience, discontinuation reasons, satisfaction measurement, and post-treatment outcomes. The insight is not only what drives uptake, it’s what drives drop-off.

Because if adherence drops sharply, the entire cost-benefit equation changes.

And that’s exactly why businesses across industries are now asking the same question in different languages: Is this a lasting shift, or a temporary bubble?

Every major disruption reaches the same inflection point- when leadership teams pause and ask: Is this real, or is this hype?

GLP-1s sit exactly on that edge.

Some signals suggest permanence: continued drug innovation, rising adoption, and growing consumer acceptance. Other signals suggest fragility: affordability barriers, side effects, and discontinuation patterns that may slow long-term momentum.

But the truth is simple: the answer will not come from headlines. It will come from evidence, measured directly from consumers, category behavior, and repeat purchase patterns.

This is where the smartest companies are shifting their approach. Instead of reacting to trend reports, they are building continuous insight engines that track what happens when consumers stay on GLP-1s for 3 months, 6 months, and 12 months, and what happens when they stop.

This is also where Jasper Colin becomes an essential part of the journey.

Over the past two years, Jasper Colin has conducted extensive interviews with diabetes patients and GLP-1 users, building real-world understanding of how appetite suppression translates into lifestyle rewiring across food, beverages, retail, fitness, beauty, and healthcare behaviors. But the larger opportunity ahead is not simply documenting what’s changing. It’s helping brands predict what changes next.

To navigate the GLP-1 era with confidence, companies will need research that answers sharper questions, such as:

The winners will not be the brands that guess correctly. They will be the brands that measure faster than the market.

This is exactly where Jasper Colin’s research frameworks deliver impact through segmentation, longitudinal consumer tracking, choice modeling, and product-market fit analysis that help organizations separate short-term noise from structural demand shifts.

Because the real risk isn’t GLP-1 adoption. The real risk is being the last company to recognize that consumer behavior has already changed.

The Ozempic effect is not just about weight loss. It is about the reshaping of everyday life from food decisions, shopping habits, social rituals, wardrobe needs, and fitness goals, to self-perception.

When appetite changes, consumption changes. When consumption changes, industries change.

And while the U.S. may be slimming, the ripple effects are expanding into nearly every corner of the economy.

For brands, the smartest strategy is not reacting to the trend, it is building the research foundation to stay ahead of it. The companies that win will be those that treat GLP-1 as a long-term behavioral shift and invest early in understanding its impact on their category, their consumers, and their future growth levers.

Because the question is no longer whether GLP-1s will reshape markets.

The question is: who will uncover the next demand curve before competitors do and who will be forced to follow it?

And that is the journey Jasper Colin is built to support.