BFSI

Understanding Brand Perception, Decision-Making Processes, and Key Drivers of Adoption in the Fintech Sector

A leading fintech platform was exploring the role and reception of financial APIs (providers, integrators, and aggregators) among finance professionals in mid-to-large UK businesses. The objective was to map their awareness, decision journey, and user satisfaction with these platforms- along with broader needs around bulk payments, ERP systems, and AISPs.

To uncover decision dynamics, integration preferences, platform satisfaction, and usage obstacles around financial APIs and related fintech solutions, with a view to informing GTM strategies, partnership models, and product development priorities.

1. Immersion & Stakeholder Hypothesis Building

We reviewed market intelligence and past client insights into API usage trends. Initial hypotheses focused on the perceived friction between IT and Finance departments, limited in-house integration capacity, and unclear aggregator value.

2. Discovery Interviews

In-depth interviews with IT and finance leaders validated the need for simplified integration models, vendor trust concerns, and the growing influence of non-banking players.

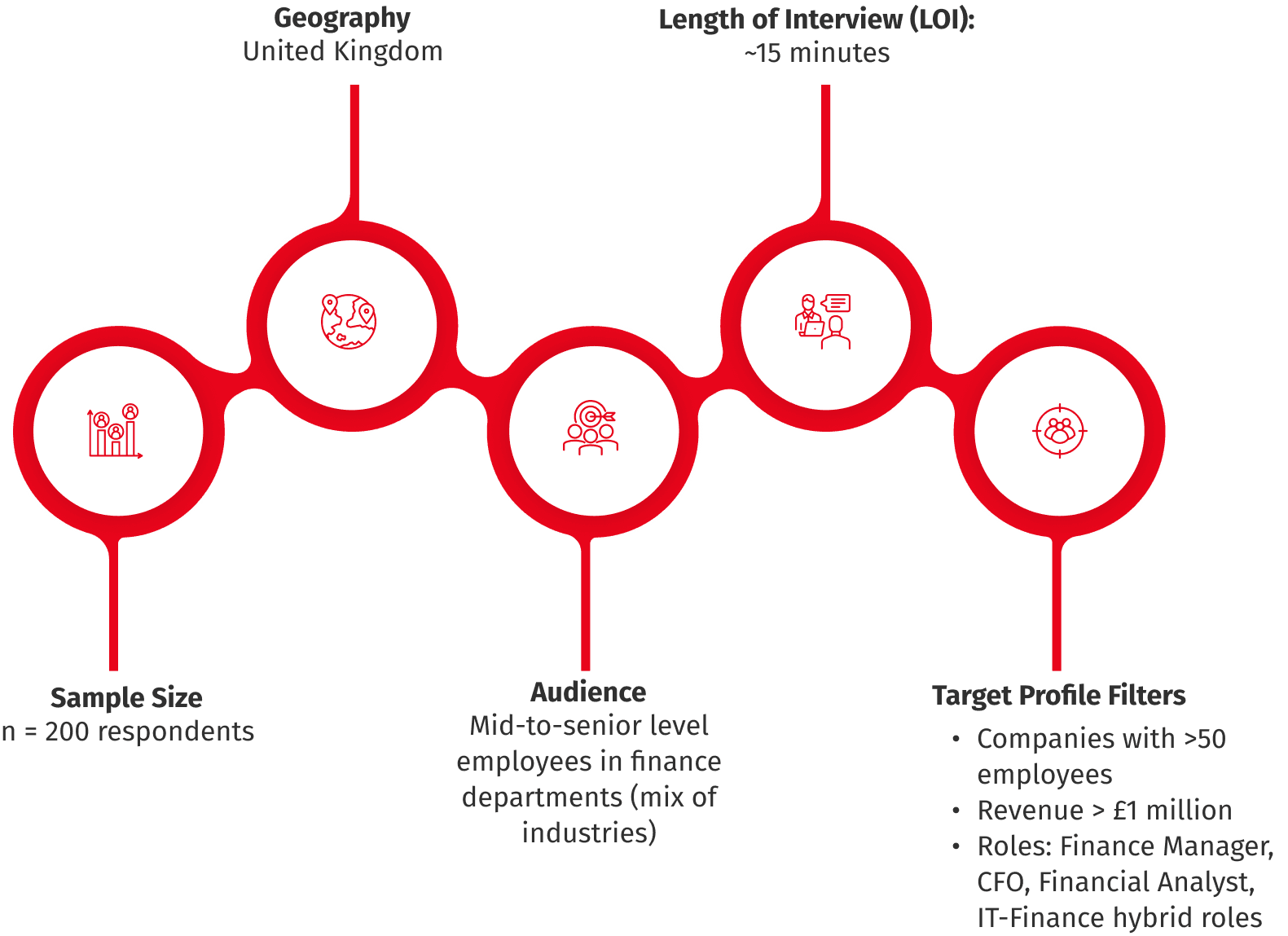

3. Quantitative Journey Survey

A 15-minute online survey mapped platform adoption, decision-making roles, evaluation criteria, and satisfaction scores across three product groups:

The survey also profiled ERP, OS, and Bulk Payment workflows to contextualize integration challenges.

4. Behavioral Contextualization

Respondents shared sources of awareness, research behavior, and switching patterns, offering digital proof points to map high-intent behaviors and content influence.

A. Financial API Providers: Usage & Decision Roles

B. API Integrators: Familiarity, Adoption, and Value Drivers

C. API Aggregators: Low Adoption, High Curiosity

D. Operating Systems & ERP/TMS Landscape

E. Bulk Payments: Modernization in Progress

F. AISPs & Financial Data Use Cases

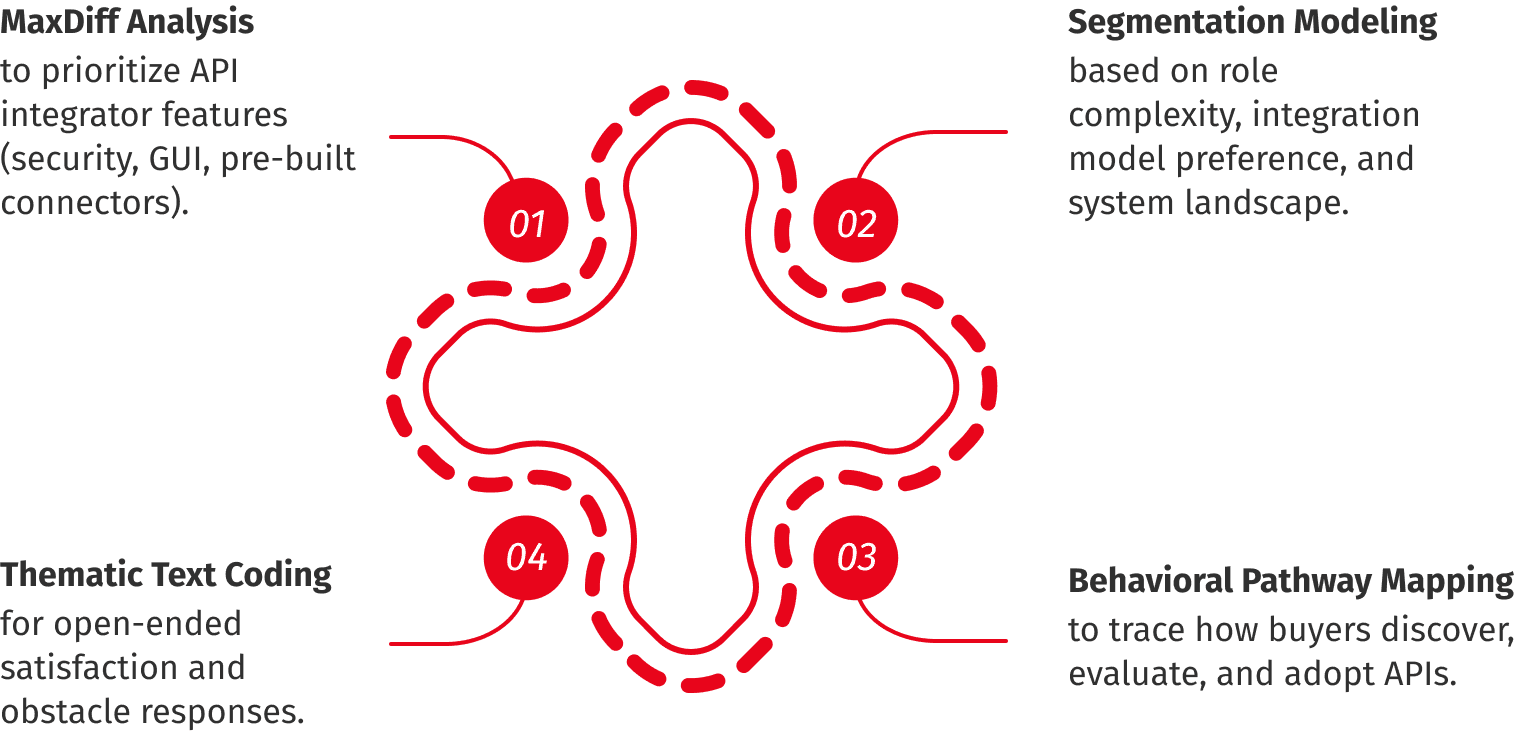

Advanced Analytics Used

1. Go-to-Market Positioning

2. Partner Alliances

3. Product Development

4. Customer Journey Optimization

This research enabled the fintech platform to:

The journey map helped connect technical use cases to emotional buying drivers- ultimately creating a narrative around efficiency, control, and trust in enterprise financial API integration.