Manufacturing

Enhancing Roofing Component Offerings

A leading roofing component manufacturer wanted to optimize their product offerings and make data-driven decisions to improve their market position. They required comprehensive insights into the most valued features of various roofing components, including vents, hip & ridge shingles, self-adhered underlayment, and mechanically attached underlayment. The objective was to assess customer preferences, identify feature trade-offs, and understand which product attributes influenced decision-making in the roofing industry.

We utilized a quantitative research strategy, focusing on MaxDiff evaluations across different categories of roofing components. This method enabled us to uncover feature preferences, assess the willingness to pay, and prioritize components that would resonate most with professional roofing contractors and decision-makers. Through the use of advanced survey techniques such as MaxDiff, Ranking, and Feature Prioritization, we gathered robust insights into how stakeholders in the roofing industry approach product selection and evaluation.

1. Screening & Demographics

We targeted a sample of 500 professionals (n=500) who are actively involved in selecting and purchasing roofing components. The survey was conducted across the USA and Germany, ensuring broad regional representation of professionals in the roofing and construction industries.

2. MaxDiff Analysis

The MaxDiff exercise was central to understanding the most important attributes for decision-making. This involved evaluating the features of roofing components like vents, shingles, and underlayment types to determine the most critical factors when choosing a brand.

Key findings:

3. Feature Prioritization & Ranking

Survey respondents were asked to rank various roofing component attributes to assess their relative importance. This exercise allowed us to establish a clear hierarchy of preferences, revealing that performance, installation ease, and durability were prioritized across all roofing component categories.

4. Willingness to Pay

We also tested the willingness to pay for premium features such as advanced protection and extended warranties on roofing components. This provided the manufacturer with valuable information on price elasticity and helped refine the pricing strategy for their product lines.

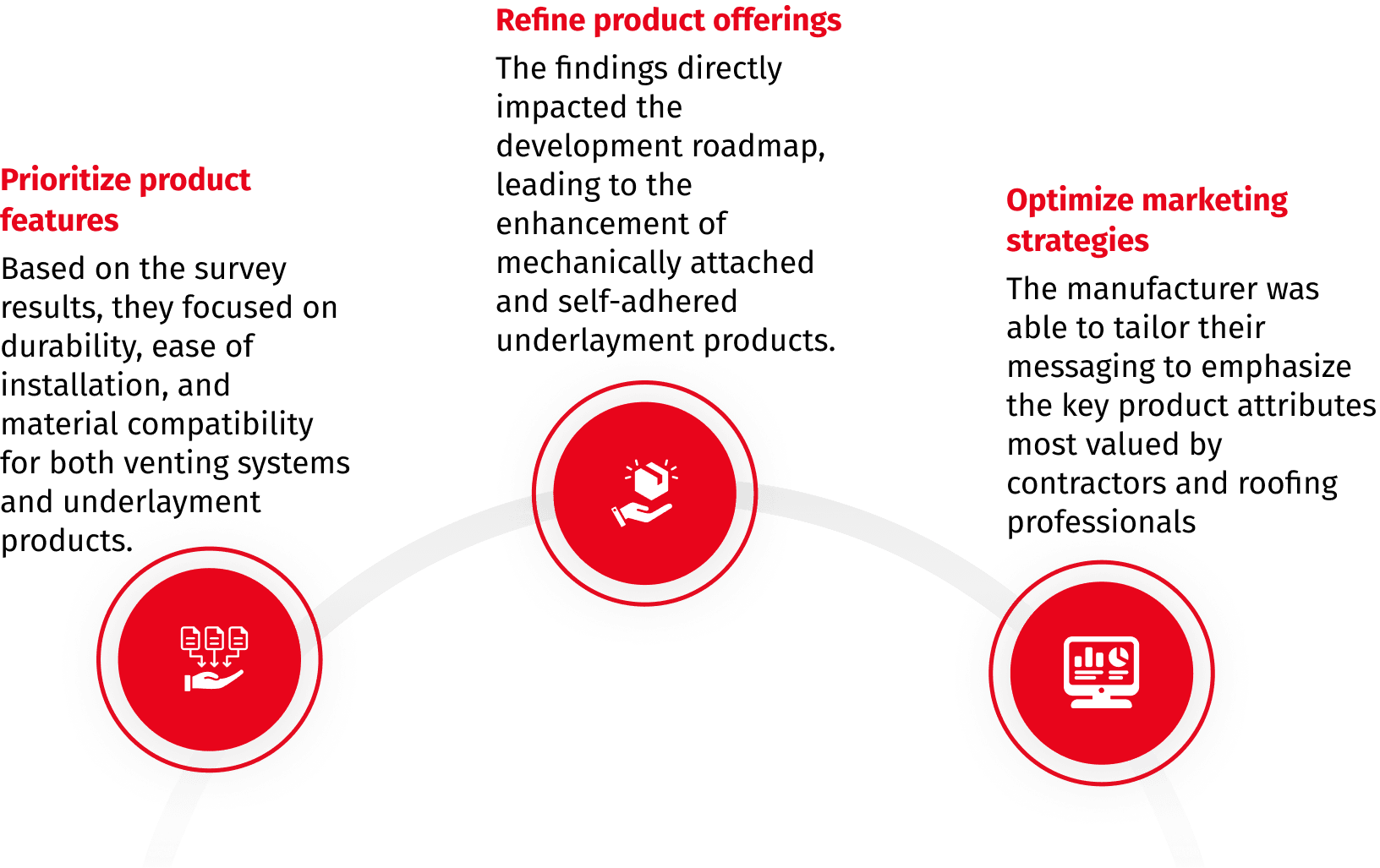

The insights garnered from this study allowed the roofing component manufacturer to:

Sample Framework

Quotas:

Through this quantitative MaxDiff evaluation, our client was able to make data-driven decisions regarding product features, optimize their pricing strategy, and enhance their marketing communications. This approach not only informed their product development efforts but also provided a clear competitive advantage by aligning their offerings with the specific needs and preferences of roofing professionals across key regions.