Manufacturing

Enhancing Roofing Component Offerings

In an effort to better understand the perceptions of business decision-makers regarding key product categories, we completed a comprehensive E&A Product Brand Equity Survey. This initiative was aimed at assessing brand equity across four distinct product contexts: hazard communication and chemical data management, ingredient and materials database search and sourcing, ESG management and reporting software, and regulatory compliance systems.

The study was designed to uncover critical insights into how business leaders perceive and engage with various product brands, helping our clients refine their market positioning, messaging, and overall brand strategy.

The primary goal of the study was to measure brand equity and understand how business decision-makers evaluate product brands within these four product areas. The study aimed to:

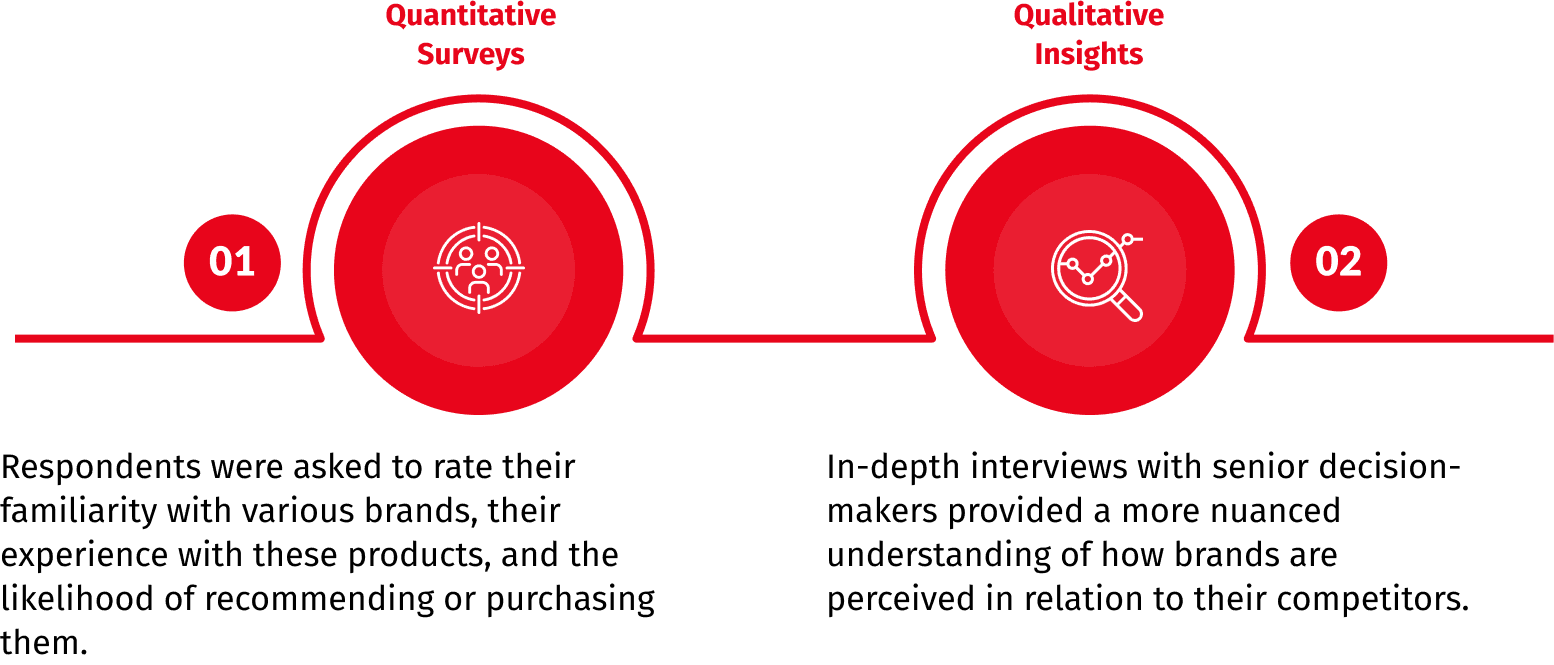

Our approach combined quantitative surveys with qualitative insights to gain a deep understanding of brand perceptions. The process was designed to be both comprehensive and efficient:

We ensured the survey was blind, with the sponsor remaining unknown to participants, which helped maintain unbiased feedback.

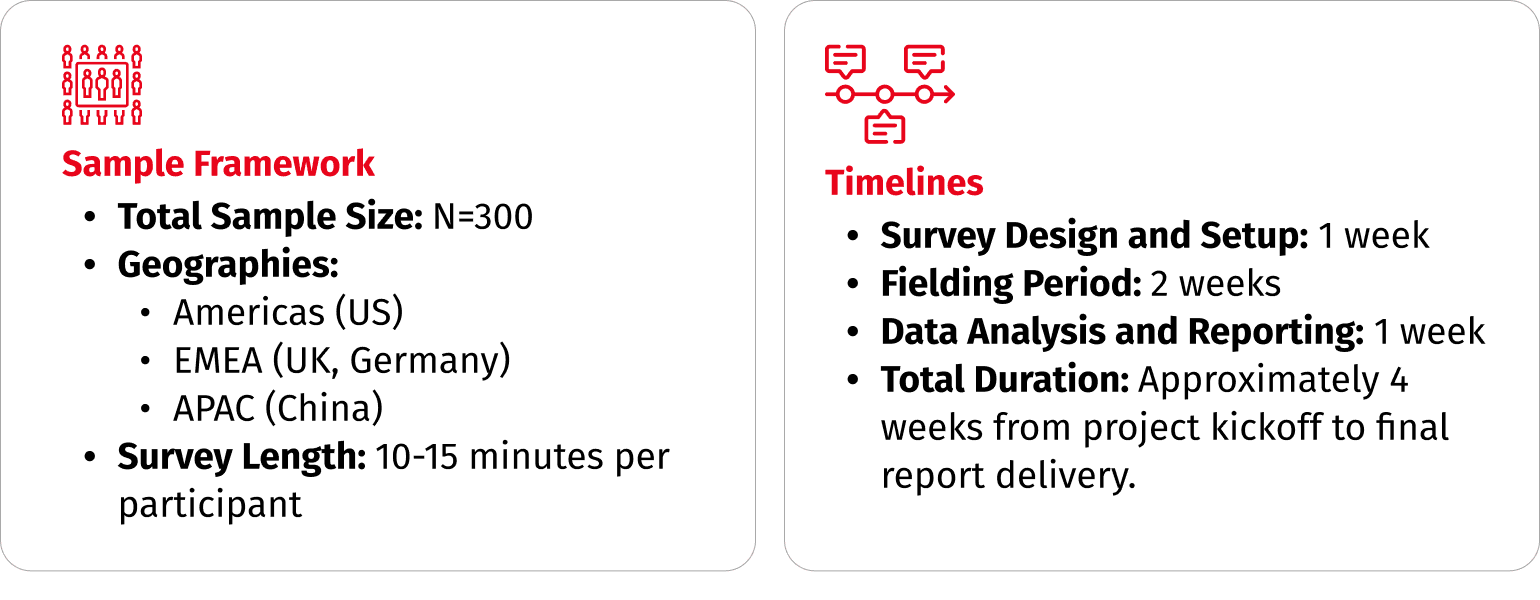

We followed a structured methodology to ensure the research was thorough and actionable:

The study focused on 300 business decision-makers from companies involved with the following product categories:

Decision-makers from various industries such as basic and industrial chemicals, automotive, medical technology, energy, and food & beverage participated, with a strong focus on roles like compliance, sustainability, R&D, and product stewardship.

The results of the E&A Product Brand Equity Survey provided actionable insights that had a significant impact on our clients' branding and marketing strategies: