BFSI

Understanding Brand Perception, Decision-Making Processes, and Key Drivers of Adoption in the Fintech Sector

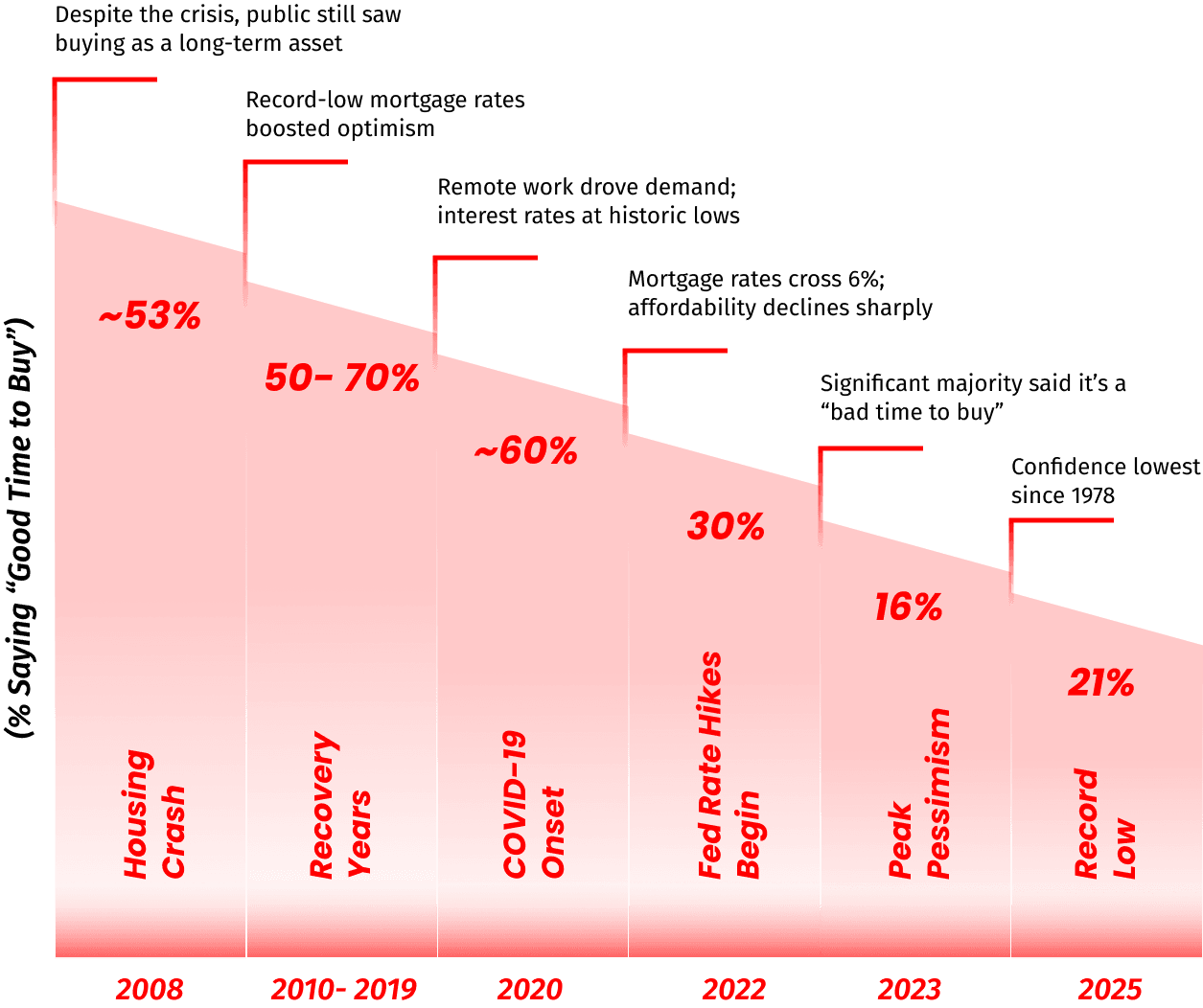

In 2025, U.S. housing confidence has hit its lowest point since 1978- only 21% of Americans believe it’s a good time to buy a home. While consumer pessimism is well-documented, industry perspectives remain underexplored.

This report fills that gap, drawing on insights from developers, lenders, builders, and housing experts to understand the drivers behind declining sentiment. By examining trends since the 2008 crash and the post-COVID shifts, we reveal how structural issues, economic pressures, and cultural attitudes have reshaped the market- and what B2B stakeholders can do in response.

Despite robust employment numbers and increased housing awareness post-COVID, 2025 marks a historic low in public confidence in the real estate market. Recent trends report that only 21% of Americans believe it's a good time to buy a house- the lowest since 1978.

While consumer perspectives are widely captured, insights from B2B stakeholders- real estate developers, financial institutions, home builders, and mortgage service providers- remain fragmented or missing.

This knowledge gap motivated us to launch an in-depth study to explore:

We implemented a mixed-method B2B research model that combined primary and secondary research to deliver a 360° view:

A. Timeline of Declining Sentiment: 2008- 2025

B. Structural Pain Points

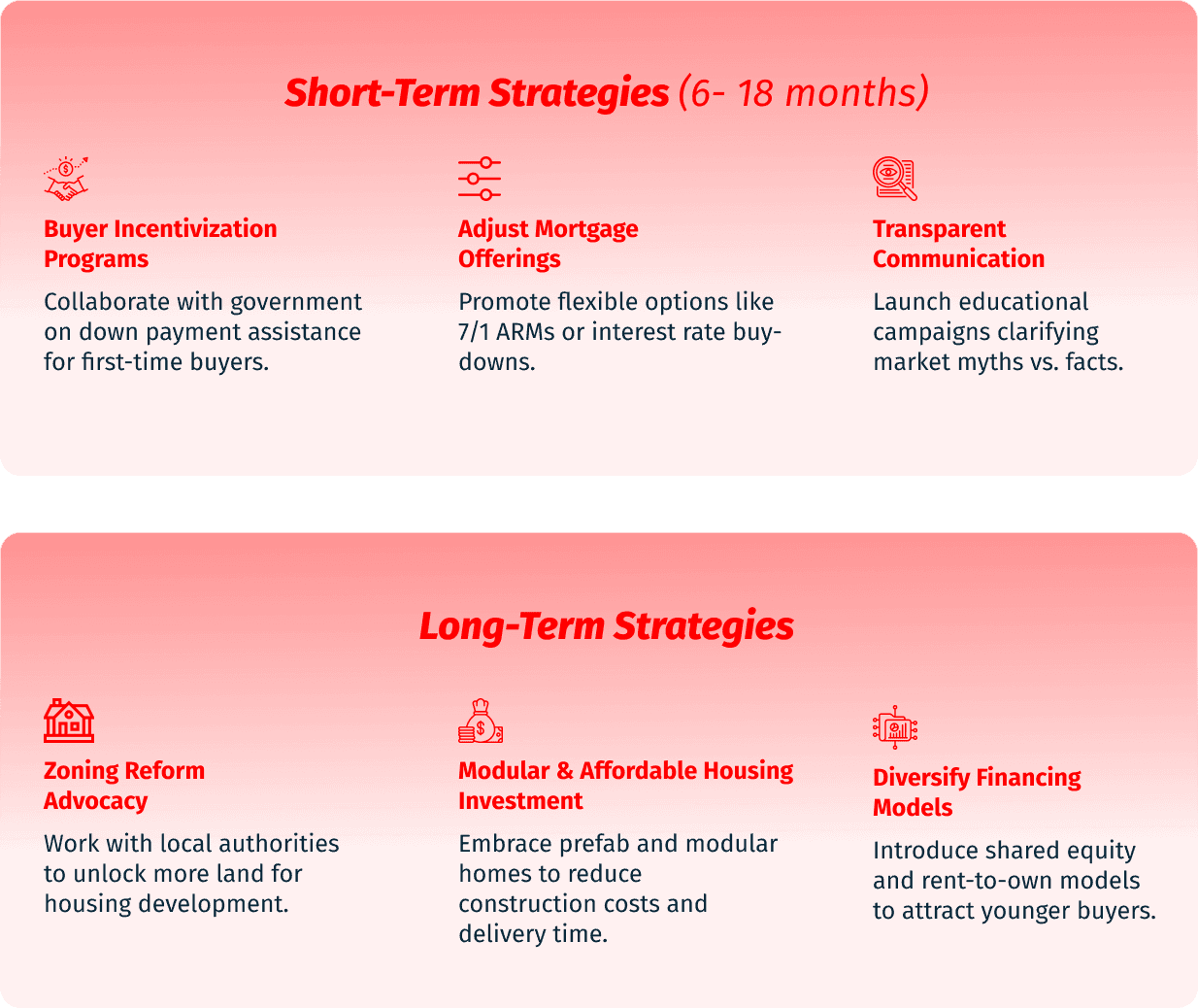

This research confirms what Americans have long suspected- homeownership is no longer an easily attainable milestone. The combination of economic stress, structural inefficiencies, and changing cultural values has created a perfect storm.

However, the U.S. housing market is at a generational inflection point. While affordability and supply remain central challenges, there is a growing opportunity for cross-industry collaboration to reshape housing accessibility and sentiment.

This study paves the way for:

We remain committed to transforming data into insight- and insight into impact- for a more resilient housing ecosystem.