BFSI

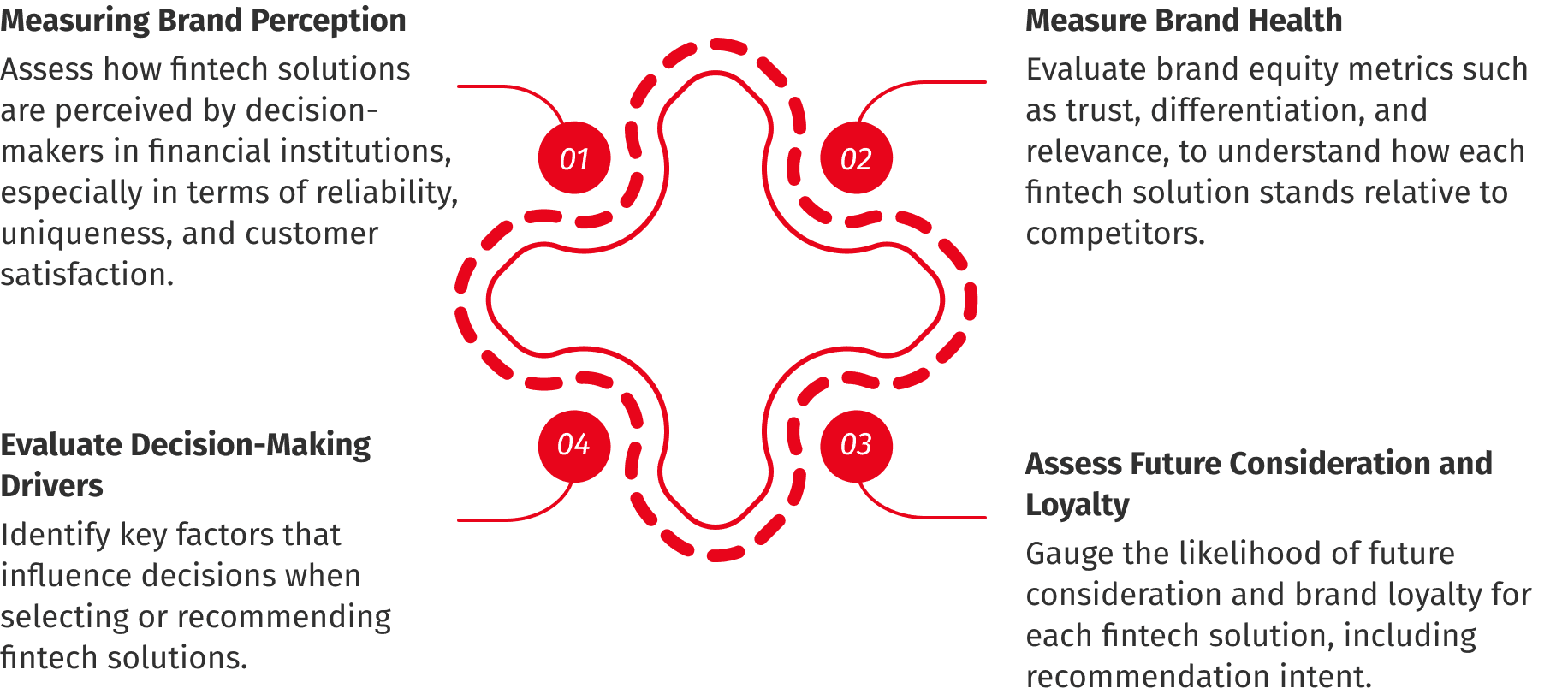

Understanding Brand Perception, Decision-Making Processes, and Key Drivers of Adoption in the Fintech Sector

In the competitive world of financial technology (fintech), understanding the perceptions of decision-makers is critical to positioning brands for success. We successfully completed a Brand Equity Assessment focusing on financial technology solutions to provide fintech companies with deep insights into their competitive positioning, customer satisfaction, and the likelihood of future adoption.

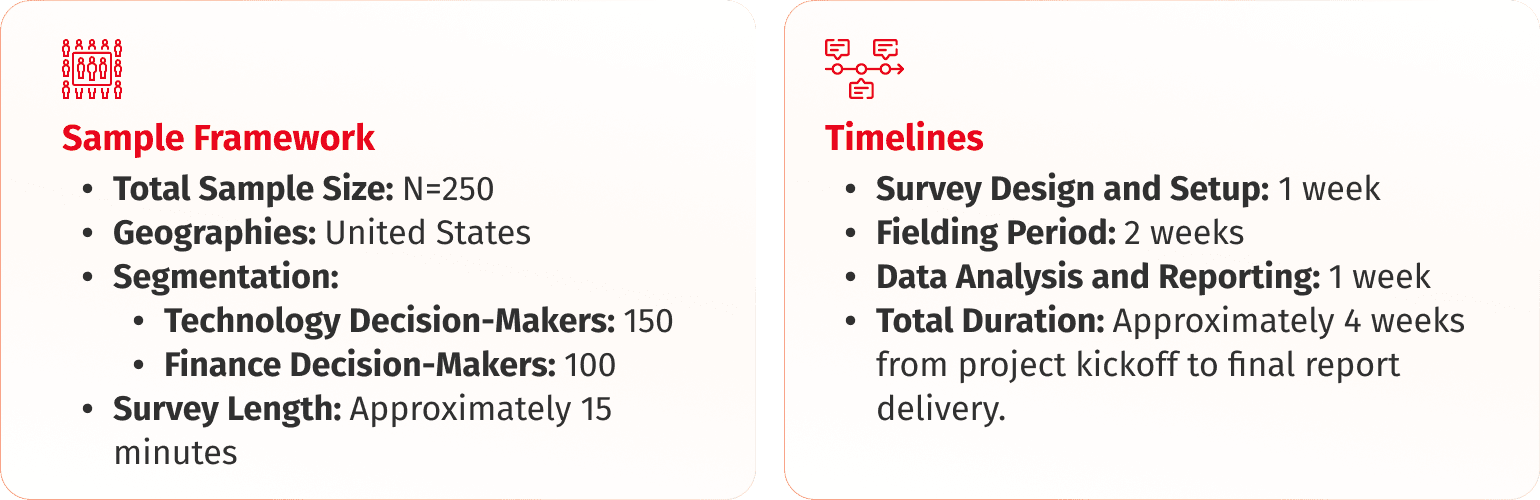

The study focused on 250 decision-makers from a variety of financial institutions, including banks, credit unions, and fintech firms, assessing how they perceive different fintech solutions in terms of trust, reliability, innovation, and customer satisfaction. The survey also measured the likelihood that decision-makers would consider or recommend specific fintech solutions in the future.

We followed a multi-method research approach that involved both quantitative surveys and qualitative insights, ensuring a comprehensive understanding of brand perception, decision-making processes, and key drivers of adoption in the fintech sector.

1. Quantitative Surveys:

2. Qualitative Insights:

3. Vertically Integrated Research Lifecycle:

3. Executive IDIs (In-Depth Interviews):

4. Brand Health Survey:

5. Advanced Analytics & Data Integration:

Target Audience

The study targeted 250 decision-makers from financial institutions, including banks, credit unions, and fintech companies. These decision-makers were responsible for evaluating and selecting fintech solutions for a variety of services such as claims processing, payments, fraud detection, and financial analytics.

Customer Loyalty & Future Consideration: The survey also assessed the likelihood that decision-makers would consider or recommend specific fintech solutions, providing actionable data on how brands can improve customer loyalty and engagement